Did you know about the average savings of up to $600 a year many drivers are receiving by using this new startup’s comparison service? If you are driving less or live in qualified zip codes, you can receive extremely low rates.

For a long time, there was no easy way to compare quotes from all of the big car insurance companies. You had to check one site, click to another, and enter all of your information all over again. You were stuck doing all the work to save money. Now, all of that has changed. Thanks to this new startup, SmartFinancial, the tools and information you need to save can all be found all in one place. SmartFinancial is not an insurer, it’s an online comparison marketplace that aims to get you the best possible rate.

What Do You Need To Do? Here Is One Quick And Easy Tip To Follow…

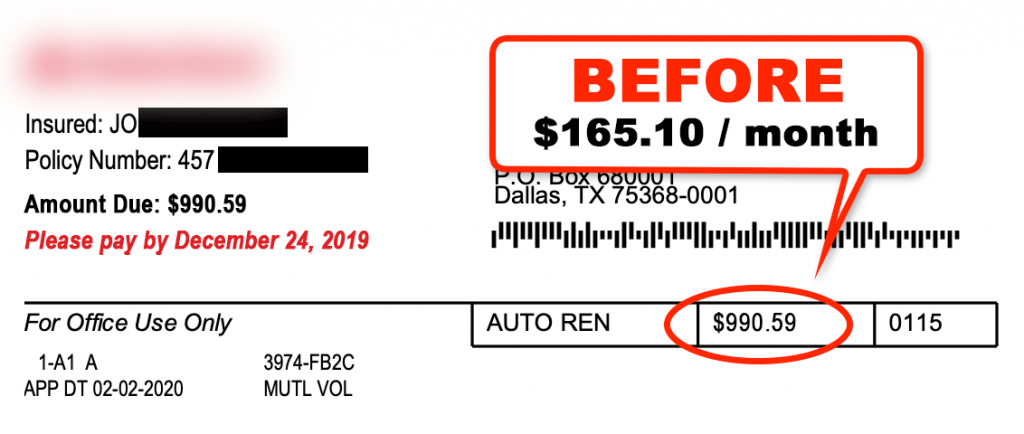

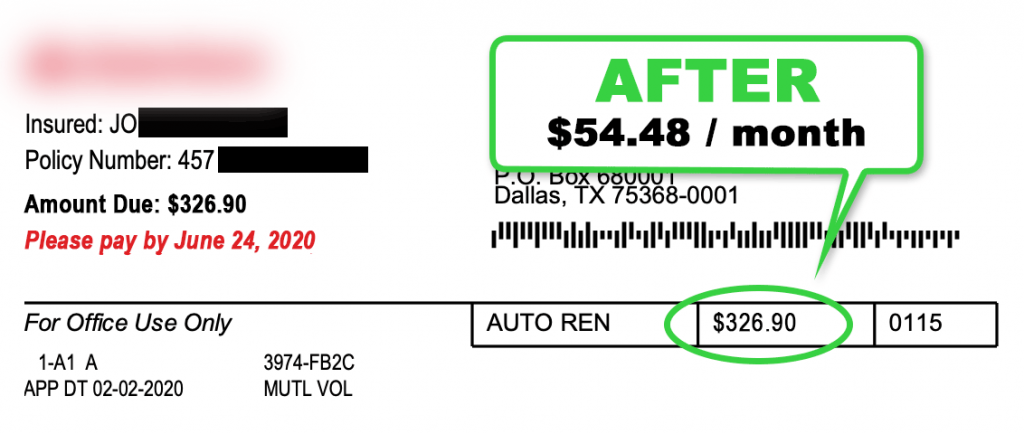

You have to compare quotes. Don’t ever buy car insurance without doing this first. After seeing average rates, we just couldn’t believe how many drivers have been overpaying. Using free services like SmartFinancial, you can easily make sure you aren’t accidentally costing yourself money in no time at all.

Drivers don’t always realize that they could be overpaying for car insurance. If you haven’t compared quotes recently, you could still be paying too much (even if you already have a low rate!). Fortunately, millions of smart drivers have started to use SmartFinancial’s free service to save hundreds a year on their car insurance.

Note: You’re NEVER trapped in your current policy. If you’ve already paid your bill, you can easily cancel and be refunded your balance.

It’s no surprise that with so many drivers saving money, SmartFinancial is gaining momentum. SmartFinancial is an excellent source that tries to give you the lowest rates possible with tools you can trust. Just think about what you could do with the hundreds you save each year!